REAP

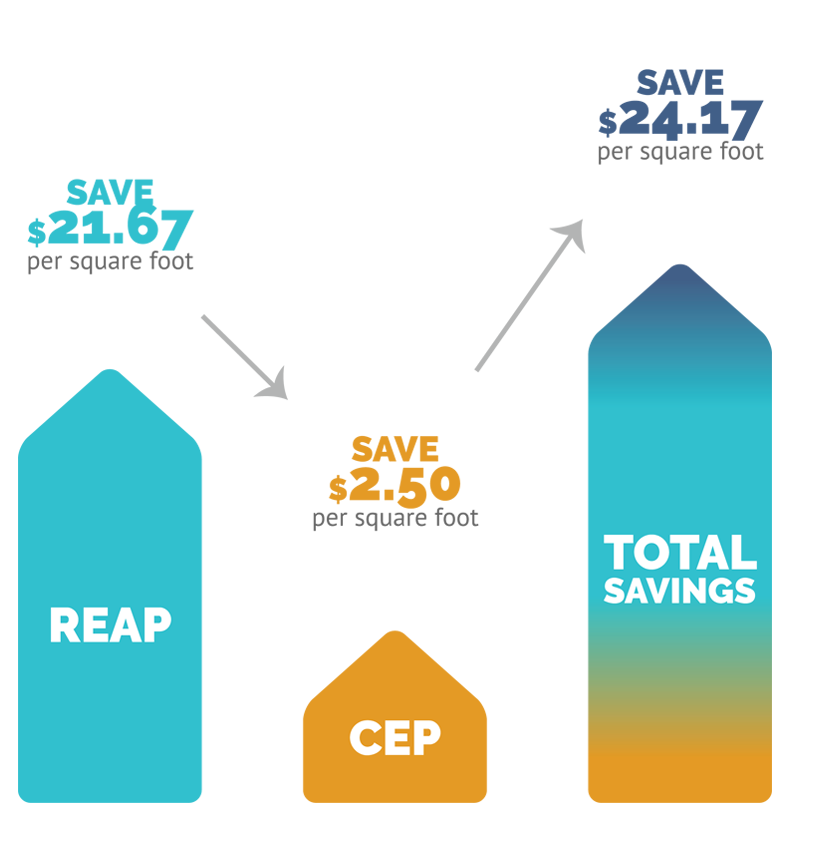

REAP provides 12 years of refundable credits of up to $3,000 per employee per year. Credits are refundable for the year of relocation and the next four years thereafter. Unused credits from subsequent years may be carried forward for five years.

The Relocation and Employment Assistance Program (REAP) offers businesses income tax credits for relocating jobs from outside of New York City or below 96th Street in Manhattan to designated locations above 96th Street in Manhattan or in one of the other four boroughs.

Benefits:

- An annual credit of $3,000 for twelve years per eligible employee

- An annual credit of $1,000 per share for relocating to parts of the eligible area that are not revitalization areas.

To apply, the eligible business has to move at least one employee from outside the REAP area to a qualified location. Please contact us for any questions regarding the lease incentives available to qualifying commercial businesses.

CEP

The Commercial Expansion Program (CEP) program is designed to increase tenant occupancy in commercial offices and industrial/manufacturing spaces. CEP provides property tax benefits for qualified new, renewal, and expansion leases in commercial offices and industrial/manufacturing spaces built before January 1, 1999.

Tax abatements up to $2.50/sf can be provided. The properties must be located in a designated abatement zone. Applicants are also required to make certain minimum physical improvements to the eligible premises and the common areas.

Please contact us for any questions regarding the lease incentives available to qualifying commercial businesses.